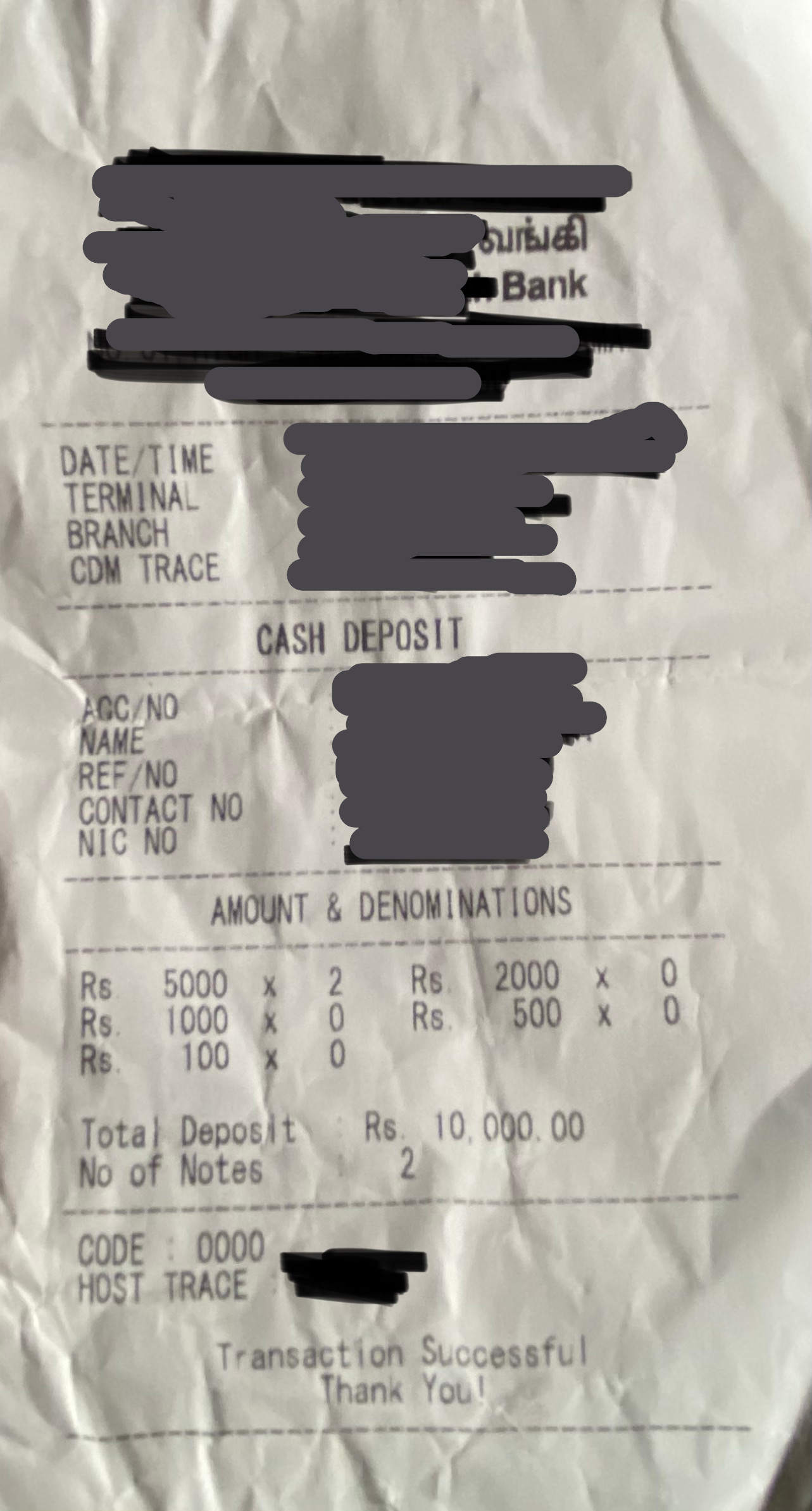

Cyber security is not just an unauthorized access to bank account, financial information or healthcare information available online but also the information which can identify and capable of giving access to an account. After a transaction, some bank transaction receipt provide sufficient enough information for an unauthorized access if the receipt has taken by an hacker after throwing away once a transaction has been completed. To better understand physical Cyber Security risk and how to avoid such risk, we have to understand the basic potential methods of avoid giving access to identifiable information.

Phone Number, Account Number, Full Name, Identification Card information which provide on some banks or bills will give access to sufficient enough information to unauthorized access to financial, healthcare, legal, and even possibility of transfer illegal transaction to the account and access after the transaction which has successfully transferred money illegally on to your account or business account and gain access to re-transfer money from the your bank account bitcoin or possible another bank account to be invisible and misrepresent as you have done a transaction illegally which will lead you to potential legal action or even law suit.

This is why, all industry workers required to understand the benefit of Cyber Security Awareness Training and basic methods to safeguard information and if the information has be compromised, how to recover, or avoid such risk in the future. Digital information we process through freely available WIFI,would be also at risk if an hacker access to information transfer through the WIFI router since all use same password. This is common in Universities, schools, and favorite coffee shop, airports, hotels, or any place which will give access to internet for free without a unique password.

As the basics security measure, always recommend to keep the receipt with you till get home and burn it or use a paper cutting machine, a scissor or a pen to erase information before throwing away. Even in most banks have given a trash to throw away the receipt after the transaction is completed but please do not throw away at the bank to avoid the risk. Also not recommend to keep a digital copy of the receipt as a picture on a device which have access through internet such as mobile device, or personal computer. Change password at least every 30 days if possible on all accounts or frequently to avoid access to the accounts if the passwords has been compromised.

As a secured method, highly recommend to check surrounded cameras when entering password or pass code before access via mobile device or laptop at open area or outdoor since it’s possible for an unauthorized personal to monitor through the surveillance cameras remotely and harvest information. If you believe that you have done any given potential risks, highly recommend to change the password. To become a Cyber Security warrior introduce us to your business or organization employees. Download free e-book here. Start the service now, and pay us later. Click here.